Why Your Private Practice Needs Its Own Bank Account

This simple step gives you financial clarity, and it doesn’t cost a thing.

For the next few weeks, I’ll be walking us through each step of my Quick Checklist to Starting a Private Practice. You can find articles on past steps here.

There’s one decision that will save you hours of future stress, prevent late-night spreadsheet meltdowns, and make your CPA love you.

It’s not your EHR.

It’s not your scheduling tool.

It’s a dedicated business checking account.

But here’s what most people don’t realize:

Most private practice therapists skip this step until tax time. Yes, you can start a private practice and roll everything through your personal account, but that is just setting yourself (and your poor CPA) up for absolute disaster come tax season.

While a business bank account helps you stay organized for tax season, this isn’t the only reason you should set one up from the start. When all your business income flows into one place, it’s easier to see what’s working, what’s draining your energy, and what you can actually afford to invest in next.

My business bank account has also allowed me to easily establish what percentage I need to be putting back into my business every month to cover business expenses. For me, that’s 5% of each paycheck (this does not include taxes). That covers my office rent, EHR system, email, yearly malpractice insurance, yearly website fees, etc.

Why This Step Matters

When you run your private practice through your personal checking account:

Your Target run is mixed in with client payments.

Your CEU course gets buried between dog food and DoorDash.

You forget what that $47 charge was for in April, and spend 20 minutes in November trying to remember.

Worse, it makes tax time an absolute mess.

Your accountant (or your future self) will thank you if you separate everything from day one.

What You Actually Need

A business checking account that:

Is free (no minimums, no maintenance fees)

Allows easy transfers to your personal account (for paying yourself)

Integrates with your accounting tools or gives clear statements

That’s it.

Options I’ve Used

I’m sure there are countless options out there, but I’ve personally used both of these:

Relay

This is my current banking platform.

No monthly fees

You can create multiple “accounts” (aka envelopes) to budget for taxes, operating expenses, and paying yourself

Great user interface, fast transfers

Easy to share with your bookkeeper or CPA

Novo

I’ve used this in the past and liked it.

Also free

Integrates with Stripe, QuickBooks, and more

Easy to use, solid app experience

Both are online-only, which means no in-person banking. But for most therapy practices, that’s irrelevant. You can request that they send you physical cards if you want to put other business expenses on the account. If you’re depositing cash regularly, a local credit union might be better.

You can also use a brick-and-mortar option like Chase or Bank of America, but most of those come with fees unless you maintain a minimum balance.

Because I eventually transitioned to an S-Corp, my second LLC banking account is through Chase. It isn’t as easy to use or convenient, but they gave me some kind of perk for setting it up attached to my personal Chase account.

My Setup

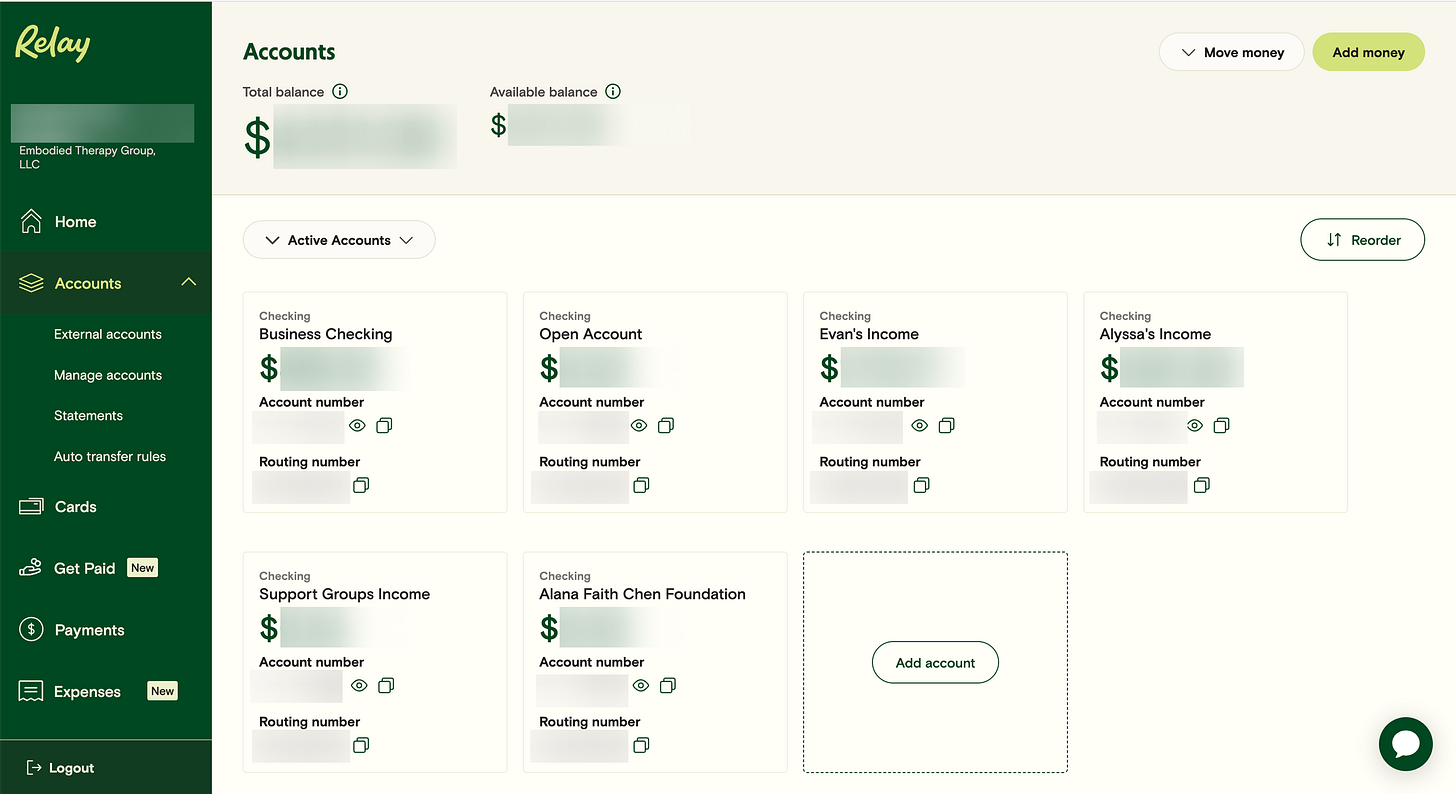

Here is how I separate folders in my business account. I have redacted sensitive information for privacy.

We categorize each account by:

My partner and I each have separate accounts for our income

Our gross income goes directly to these accounts from our credit card processing platform (more on that in a few weeks)

We can use an easy ACH Transfer to then send our income to our personal accounts

Business checking account that we pay for all of our business expenses through (this is where I put that 5% of each paycheck that I mentioned earlier)

Account for income from groups so that we can then divide that income amongst ourselves and business expenses

Alana Faith Chen Foundation is a separate grant account that funds some of our clients’ therapy (more on working with foundations for funding in the future)

We also work with the Crime Victim’s Compensation Fund and other organizations to help our client’s pay for therapy

“Open Account” is our old colleague’s income account that I have been too lazy to close (good thing Relay lets us open as many accounts as we want for free!)

*** You could also have an account on here for your taxes. Personally, I choose to put all of my tax money into a High Yield Savings Account to accrue interest on what I save each month. ***

I also keep track of income and tax write-offs through a spreadsheet that I can share in the future. This is just an extra step to be even more organized when taxes roll around.

How This Helps Long-Term

All your gross income should go through this account. You’ll pay for your business expenses from it, set aside money for taxes, and transfer your take-home pay to your personal checking account. This process makes all your business finances clean, simple, and trackable. I have a separate account for each of these categories in my banking app, to make things as simple as possible.

You’ll also be in a better position if you ever want to apply for a business credit card, secure a small business loan, or just make a solid financial plan.

At the End of the Day…

Open a separate business checking account the moment your LLC is official. Use it for everything business-related. Keep your practice finances clean. Don’t wait until April to wish you had.

Your nervous system (and your CPA) will thank you.